A family office is a private wealth management entity that provides a comprehensive suite of services to high-net-worth families and individuals. These offices are typically established by affluent families with complex financial needs, including the management of lifestyle and luxury assets, accounting and regulatory reporting, succession planning and philanthropic investments.

The primary goal of a family office is to manage the wealth of a family and ensure that it is preserved and grown over generations. Family offices provide customised solutions that are tailored to the specific needs of each family, and they offer a range of services that are designed to meet the unique challenges and opportunities that come with managing substantial wealth.

What are the different types of family offices?

The personal assistant

Sometimes the family office can be essentially a PA service. The family needs someone to help them with their daily needs - which can be anything from drafting letters to arranging flights and accommodation to walking the dog. The family office in this instance is a matter of convenience.

The concierge/lifestyle manager

When the needs of the family become more complex, the emphasis shifts beyond the requirement of a PA. A more proactive solution is required in the form of concierge or lifestyle manager who can monitor and deal with daily logistical issues such as household staff management, organising insurance across the family’s assets, liaising with charities that the family support, and sometimes simply being a listening ear for family members. The type of person who manages this sort of office usually has deep understanding of professional services or a concierge firm.

The financial office

In addition to managing lifestyle needs, often the family needs someone who can manage their day-to-day financial affairs - paying bills, placing fixed deposits, paying household staff and managing daily cash needs. Often this person is a bookkeeper or accountant, and is on many occasions someone who has been known to the family for some time, perhaps working as an accountant in their family business.

The family business office

This type of office is dedicated to managing the affairs of the family-owned business. The primary function of a family business office is to provide support to the family members who own and operate the business. Where a family might have multiple businesses, they may require someone to act as ‘head office’ to ensure that the businesses are not unnecessarily competing with each other to ensure good corporate governance. The individuals working in this sort of family office usually have strong experience in business management and may often sit as a director on the investee companies.

The administrative family office

Sometimes a client of a bank or a fiduciary services firm will have many complex structures in place to manage their financial and personal affairs. The administrative burden of managing those structures sometimes creates the need to have a full-time, dedicated team whose main purpose is to ensure that the companies and trusts within the structure are being managed effectively.

The family investment office

This type of business is usually staffed by investment professionals. Their main purpose is to take the family's wealth that sits outside of the personal assets (homes, planes, boats etc) and invest it, often under their own discretion, with the objective of achieving a client's required return on investment. This type of office can have a listed equities focus, a hedge fund focus or even a property focus. The main characteristic of these types of office is that they live or die by their investment performance, and they are normally remunerated on investment performance or assets under management.

The trusted adviser family office

This type of office has a deep and trusted relationship with the family to the extent that they have the same ‘helicopter view’ of the family's financial and personal situation that the patriarch or matriarch does. This allows the office to be involved in wealth and tax planning, liquidity forecasting, asset allocation and transmission of wealth between generations.

The full-service family office

This type of family office offers a comprehensive suite of services, as listed above, in order to provide a one-stop-shop.

It requires two key components to be in place:

- The family have a degree of complexity regarding their affairs. This creates the necessity to manage lifestyle needs, bill payments, manage personal assets such as homes, aircraft and motor vessels, oversee complex investments such as private equity, property interests or even classic car collections, and may also include managing the family's charitable foundations.

- There is high degree of trust between family and family office professionals. This is essential to allow the professionals to become Trusted Advisers.

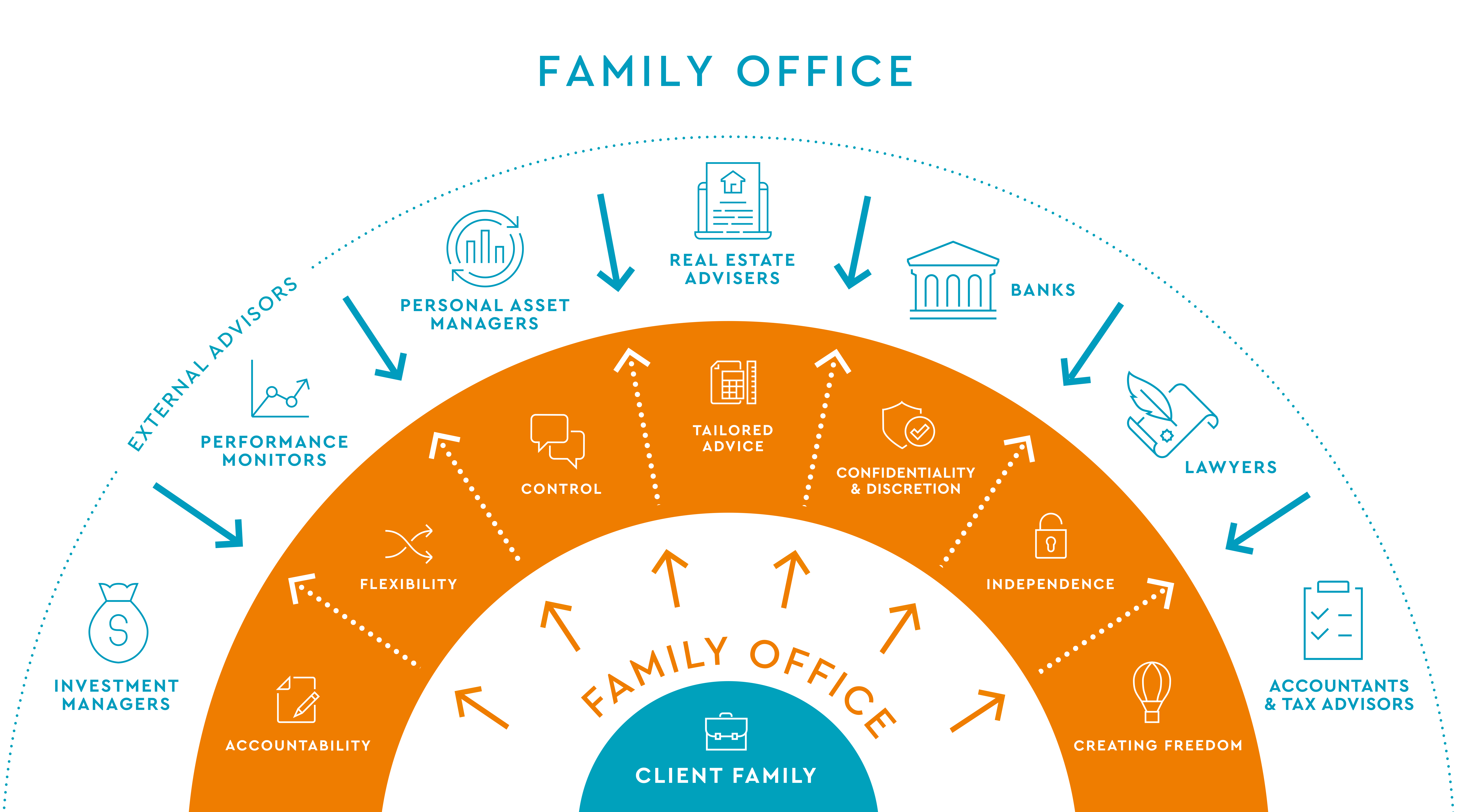

What does a full-service family office look like?

The diagram below shows that the client family sit at the heart of the organisation. The full-service family office professionals act as the gatekeeper between family and external advisers, supervise their performance, and take and implement their advice.

Download a complete guide to family office

We have produced a three-chapter overview of the operational considerations and common family office scenarios that wealth professionals should take into account when considering establishing a family office for their client family.

How can Ocorian help?

Our dedicated family office team can provide a seamless and holistic approach to the challenges and opportunities families face.

We offer a wide range of administrative and lifestyle services to a single individual or family, or establish and maintain a sophisticated and full family office for those with more complex needs.

We can support your wealth by acting as an outsourced family office or multi-family office work and with established family offices or advisors to fill gaps in their in-house provision.

Visit our Family Office page to find out more.