New research from Ocorian a market leader in regulation and compliance services for funds, corporates, capital markets and private clients, reveals that fund managers in the Channel Islands are braced for a rise in fines for breaking regulations.

88% Channel Islands investment managers believe number and value of fines will increase

Ocorian’s study with venture capital and real estate fund managers and family office investment managers based in the Channel Islands found 88% questioned believe the number and overall value of fines issued in their sectors for breaking regulations will increase.

All those questioned said their organisations are preparing or budgeting for a potential increase in fines.

Aron Brown, Head of Regulatory & Compliance at Ocorian commented: "This might explain why one in 12 (8%) believe their organisations are too focused on compliance and regulation and not on commercial aspirations but good governance and robust compliance preparedness enhances commercial prospects and wins business.

“This can be perceived in more than one way, of course, but in our view, this result shows that the Channel Islands believes in regulation and supports what the regulator wants to achieve – shown in the overwhelming number of respondents who believe their organisations have the right focus on compliance and regulation.

“We see investors are increasingly cautious about where they invest so if they can find a good governance and compliance framework, they are more likely to invest.”

The Channel Islands research is part of an international study among senior executives at major companies and investment managers with family offices, private equity, venture capital and real estate funds as well as senior capital markets executives by Ocorian.

The study in the Channel Islands found all those interviewed believe their market is currently heavily-regulated and are united in their belief the level of regulation will increase over the next five years. Nearly one in four (24%) expect a dramatic increase.

Need for regulatory and compliance expertise as 68% say adhering to regulations will be more difficult over next five years

When it comes to their organisation adhering to regulations in the different jurisdictions they operate in, only 36% of those surveyed say it is not an issue – 48% say they find it very difficult to do this, and 16% say it is quite difficult. Some 68% believe their organisation will find it more difficult to do this over the next five years, and just 24% believe it will become easier.

Despite worries about regulation all the respondents say their organisation is good at meeting its regulatory requirements. Nearly nine out of 10 (88%) surveyed say their organisation’s executive board takes regulation and compliance issues very seriously while just 12% say they could focus more on regulation.

Trend of outsourcing to third parties to ensure compliance

Cilla Torode, Head of Relationship Management at Newgate Compliance, an Ocorian subsidiary said: “Alternative fund managers and family office investment managers are clearly concerned about the regulation they face in the different jurisdictions they operate in, and are taking action to ensure they meet best practice standards.

“Some are increasingly outsourcing to third parties like us to support them in this area, and they are also increasing their budgets for ensuring they are compliant. Indeed, 96% of those professionals we interviewed expect the organisations they work for to increase their budgets for regulation and compliance over the next five years with 12% forecasting a dramatic increase.”

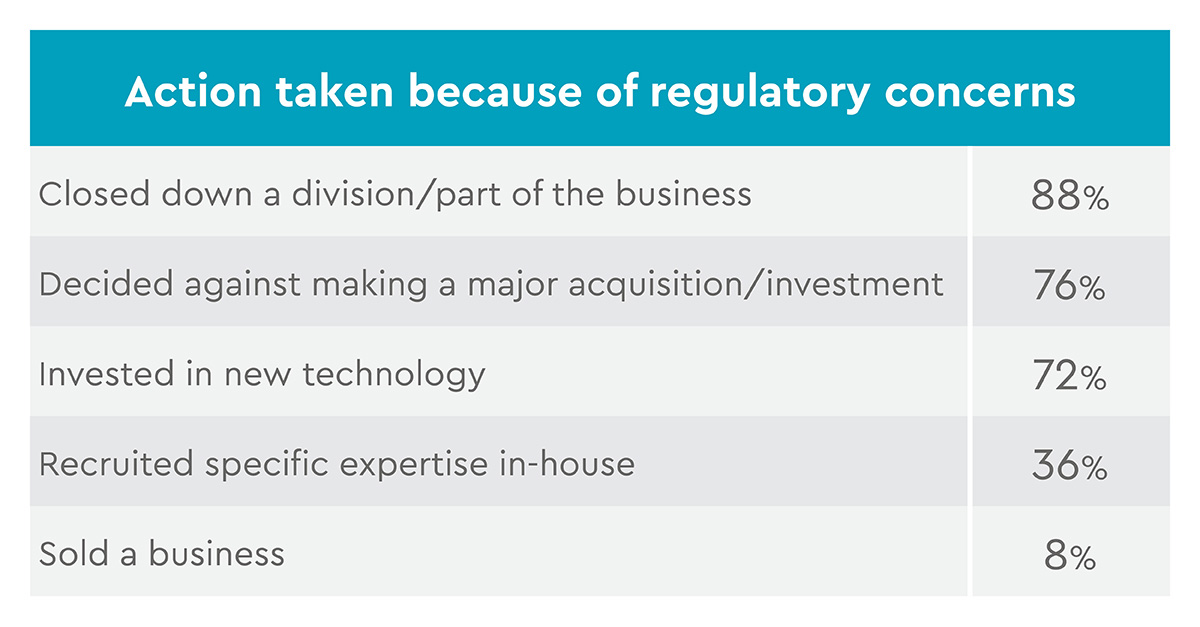

The research also identified other actions professional investors and corporates have taken as a result of difficulties regarding regulatory issues. Nearly nine out of 10 (88%) said they had closed down a division or part of the business because of potential regulatory issues while 76% had decided against a major acquisition and 72% had invested in new technology.

Alison Dodd, Head of New Business at Newgate, an Ocorian subsidiary, remarked: “We found it really interesting that 8% of Channel Islands respondents surveyed believe their organisations are too focused on compliance and regulation and not on commercial aspirations, and 8% sold a business over the past five years because of regulatory concerns. The data is anonymous so we can’t tell if the 8% represents the same respondents, but it’s an eye-catching symmetry.”

Ocorian’s subsidiary compliance consultancy service, Newgate Compliance assists clients with a broad range of compliance services such as submission of regulatory authorisation applications, provision of Money Laundering Reporting Officers (MLROs), the implementation of compliance frameworks and governance structures, as well as regulatory and compliance training for employees.

Backed by their innovative cloud-based regulatory compliance solution, The Gateway, the fast growing team led by experts and ex-regulators delivers pragmatic and flexible solutions to help clients meet complex and evolving regulatory obligations.

Contact Newgate’s compliance experts today to fortify your compliance framework.

*Ocorian commissioned independent research company PureProfile to conduct a global study of 301 senior executives. The survey was carried out among board directors at companies with annual turnover of more than $250 million, fund managers working in family offices, private equity, venture capital and real estate; and senior executives working in capital markets focused on structured credit, CLOs, securitisation, mortgage-backed securities and asset- backed securities. Respondents to the survey, which was conducted in November 2023, were based in the UK, continental Europe, Asia, the Middle East and North America. The research included 25 responses from the Channel Islands from real estate and venture capital fund managers and investment managers working for family offices