Whilst the voluntary liquidation process in Luxembourg is well-structured, Head of Corporate Services, Rémy Cornet explains how it needs to be followed carefully.

Funds in Luxembourg own and invest in companies in a vast range of sectors, from property to finance and IP rights, and the attraction of the jurisdiction as a place to domicile their assets is understandable, especially given its favourable operating environment – with a multilingual workforce, overtly business-oriented government, and cross-border financial expertise.

What makes Luxembourg a popular location for processing voluntary liquidations?

Luxembourg also offers compelling structures. Its special purpose vehicles (SPVs), for example, have proven hugely popular with multinational private equity and real estate groups, offering huge potential for tax optimisation when they come to sell their assets for capital gains.

One interesting side-effect of its magnetic pull to Luxembourg is that these structures also require servicing at the end of their lives, so Luxembourg also boasts a large number of voluntary liquidations – these are deliberate dissolutions on the part of the shareholders of the company in question.

At Ocorian, we act on around 50 separate mandates a year, either as liquidator or liquidation auditor, for multinational clients looking for a service provider on voluntary liquidations. In our experience, a high proportion of entities incorporated in Luxembourg are intermediate holding companies for the jurisdiction’s private equity and real estate businesses, for which voluntary liquidation is typically the natural conclusion of the lifecycle.

Companies tend to be incorporated, expanded and, within just a few years, sold – at which point the company can effectively become an empty shell, with no further reason to exist. Liquidation is simply the inevitable final step, to avoid triggering any additional fees for accountancy or other services.

How do voluntary liquidations differ?

For those with a small amount of cash on the balance sheet, a voluntary liquidation can be a simple, mechanical process that’s closed in two weeks. At the other end of the scale, owners of the entity may have a reason to hold onto certain assets for several years, even if they’re adding no further value, in which case a liquidator may be brought in to manage them.

What are the three stages to voluntary liquidation in Luxembourg?

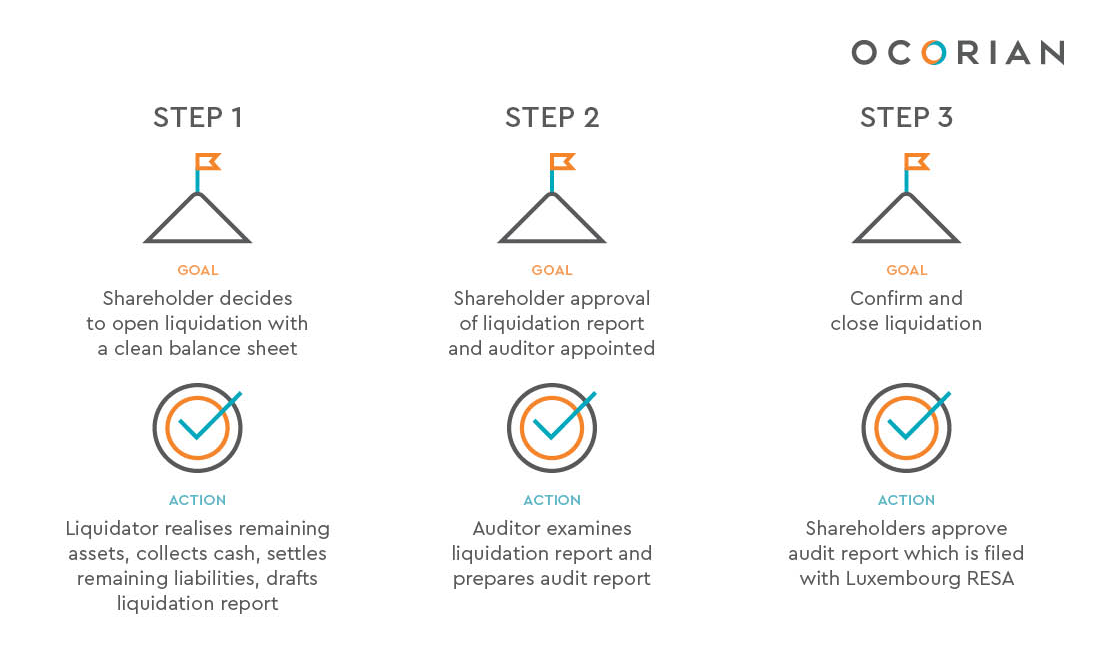

Whatever the complexity of the voluntary liquidation, the process should follow the same basic formula, usually in three clear steps:

1. Opening the Liquidation & appointing a liquidator

The first is to open the liquidation, with a meeting of the company management in the presence of a Luxembourg notary, who appoints a liquidator to take over. From this point on, the liquidator represents the company, which remains a legal entity solely for the purposes of the liquidation. The aim when opening liquidation is to kick off the process with as clean a balance sheet as possible, meaning the owners have realised or sold the company’s main assets. The liquidator's role is to assess the balance sheet to realise any assets that do remain, to collect any cash due and settle its final liabilities – and to draft the liquidation report.

2. Approving the liquidation report & appointing a liquidation auditor

In the second step, the shareholders meet again to approve the liquidation report and appoint a liquidation auditor, who is given a mandate to examine the liquidation report and prepare an audit report.

3. Final shareholder meeting & closure of the liquidation

The third stage is a final shareholder meeting to approve this second report, and to confirm and close the liquidation, which is then filed with the Luxembourg Trade and Companies Register and published in the Luxembourg Recueil Electronique des Sociétés et Associations. It’s important to do this as soon as possible, as the company can still answer to creditors for as much as five years after the date of publication – what’s known as the ‘passive survival’ of the company.

Thanks to its thoroughness, this formula of a three-step approach to liquidation is generally recommended. A liquidation can sometimes be completed in just one or two steps, skipping the final audit stage and perhaps even the appointment of the liquidator. This, however, is appropriate only in certain limited cases, where the simplicity of the company’s assets allow it.

How to liquidate your Luxembourg company:

What are the risks & responsibilities involved in voluntary liquidation?

The liquidation process may appear straightforward, but there is a significant degree of risk and responsibility involved. Anyone using Luxembourg SPVs, for example, has to comply with certain parameters around domiciling, accounting and tax. Any inaccuracies here will show up during the liquidation procedure and can lead to compliance issues.

In most voluntary liquidations, the owner of the entity may choose to distance themselves from any potential complications by handing the liquidation process to an experienced third-party specialist, such as Ocorian, who will be able to ensure everything is in order and complete it in a prompt, efficient and streamlined manner. The owner of the entity, meanwhile, is suddenly rendered free to focus on other business – which is likely to be of higher value.

How can Ocorian help?

Our specialist team have extensive knowledge and experience in winding up obsolete entities and handle hundreds of voluntary liquidations a year.

For information about how Ocorian can support your liquidation proceedings, get in touch with our team today.