94% family offices expect to increase acquisitions and investments in 2024

Family offices are poised to increase acquisitions and investments in the year ahead as they react to increasing opportunities, new research* from Ocorian, a market leading global provider of services to high-net-worth individuals and family offices, financial institutions, asset managers and corporates, shows.

The study which interviewed family office professionals in Europe, Asia, the Middle East, North America and the UK, found the potential buying spree is being driven by a growing belief that company valuations are becoming more realistic.

Almost all (94%) of family office professionals questioned say they expect to increase the number of acquisitions and investments their family office makes in 2024 compared to the previous year. Around 18% expect to dramatically increase acquisitions and investments while 6% expect to deliver the same level of acquisitions and investments.

Around 62% say they will expand acquisition plans as company valuations are becoming more realistic and attractive while 60% say the rising cost of debt is forcing more companies to look for investors.

However, part of the rise in acquisitions is down to a strategic shift – nearly half (49%) questioned say they want to increase levels of direct investing while 21% say they are cash rich and 9% admit they need to diversify.

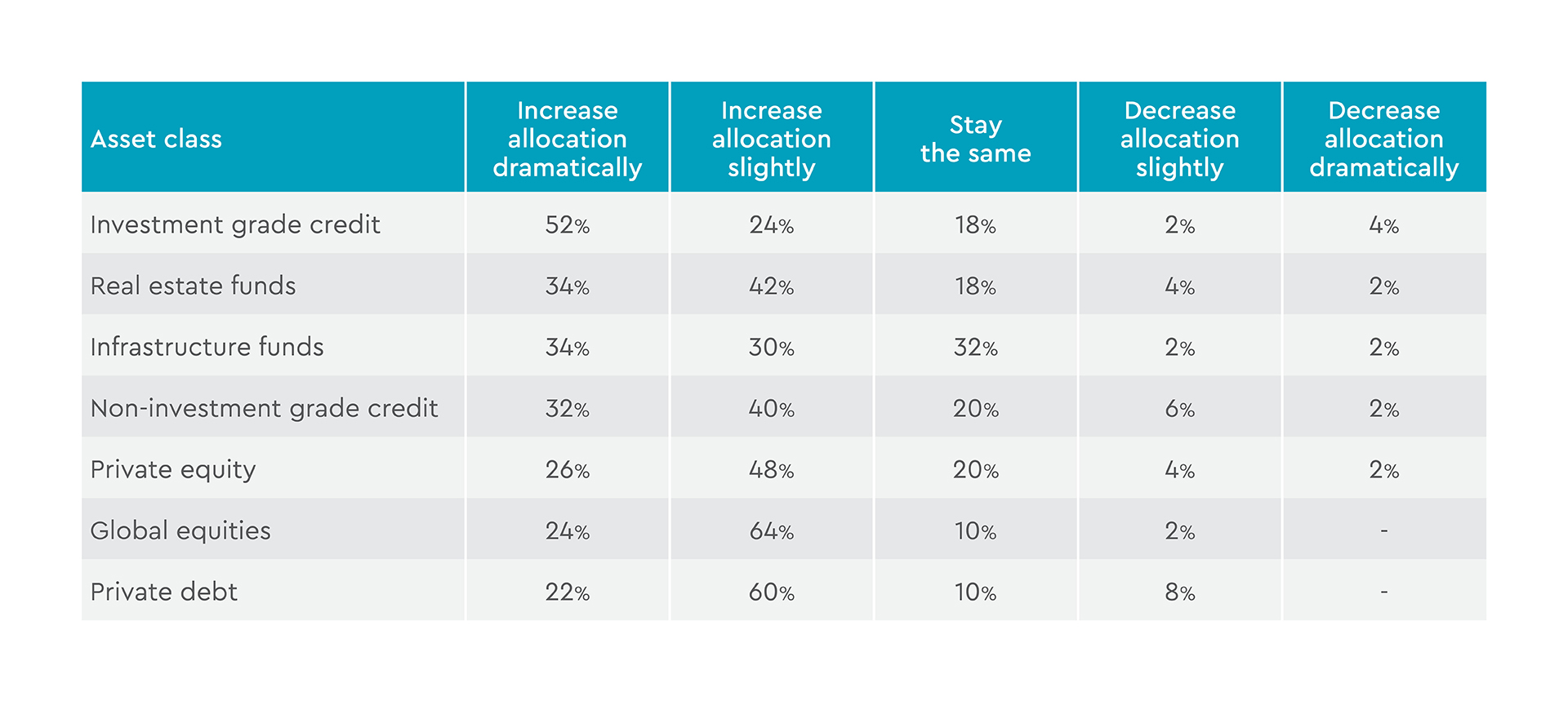

Investment grade credit is likely to see the biggest increase in allocations from family offices

The study found that investment grade credit is likely to see the biggest rise in family office investment allocations in the year ahead with more than half (52%) planning to increase allocations dramatically. However all alternative asset classes and global equities are likely to see more investments from family offices as the table below shows.

Amy Collins, Head of Family Office at Ocorian, said: “The family office sector is growing rapidly and going through a series of tactical and more structural changes - as the study shows - with family offices set to go on a buying spree in the year ahead.

“With interest rates having been so low for so long, the increases have created a new way to look at certain asset classes. Where the principals served by family offices, whether they be younger or simply of a different generational mindset, are more focused on exploring private equity and direct investment opportunities, we are seeing more of that as a trend – this is a trend we identified in our research at the start of 2023 where almost all agree of the family office professionals questioned** said that the sector is increasingly investing in alternatives and the switch is a long-term trend. Around 42% strongly agree with the view.

“Many family offices had largely held back from the markets and wider investment during the pandemic and its aftermath before changing course during 2023 and increasing investments across a range of sectors and particularly the alternative fund sector.

“It’s great to see that the family office professionals we questioned foresee much more activity in 2024 and the positive outlook they’re suggesting, but we do wonder whether this will be the case of if it will buffer into 2025 and beyond.”

Ocorian’s award winning dedicated family office team provides a seamless and holistic approach to the challenges and opportunities families face. Its service is built on long-term personal relationships that are founded on a deep understanding of what matters to family office clients. Its global presence means Ocorian can provide bespoke structures and services for international families no matter where they live.

*In November 2023, Ocorian commissioned independent research company PureProfile to conduct a global study of 301 senior executives. The survey was carried out among board directors at companies with annual turnover of more than $250 million, fund managers working in family offices, private equity, venture capital and real estate; and senior executives working in capital markets focused on structured credit, CLOs, securitisation, mortgage-backed securities and asset- backed securities. Respondents to the survey, which was conducted in November 2023, were based in the UK, continental Europe, Asia, the Middle East and North America and included 50 family office investment managers

** In March 2023, Ocorian commissioned independent research company PureProfile to interview 134 family office investment managers working for family offices which use third-party private client services providers to support in the preservation and protection of their clients’ wealth. The investment managers interviewed are responsible for assets under management of $62.45 billion and include 63 working for multi-family offices. The global study interviewed family offices in the US, UK, Canada, China, Germany, India, Norway, Saudi Arabia, Singapore, South Africa, Sweden Switzerland, UAE, Denmark, France and Japan

Download Ocorian's Outlook 2024 report here: