Global value of private assets held in funds has increased 9.6% this year to an all-time high of $14.05 trillion

Ocorian’s Global Assets Monitor forecasts global values will hit $23.9 trillion within five years with private equity nearly doubling to $17.4 trillion

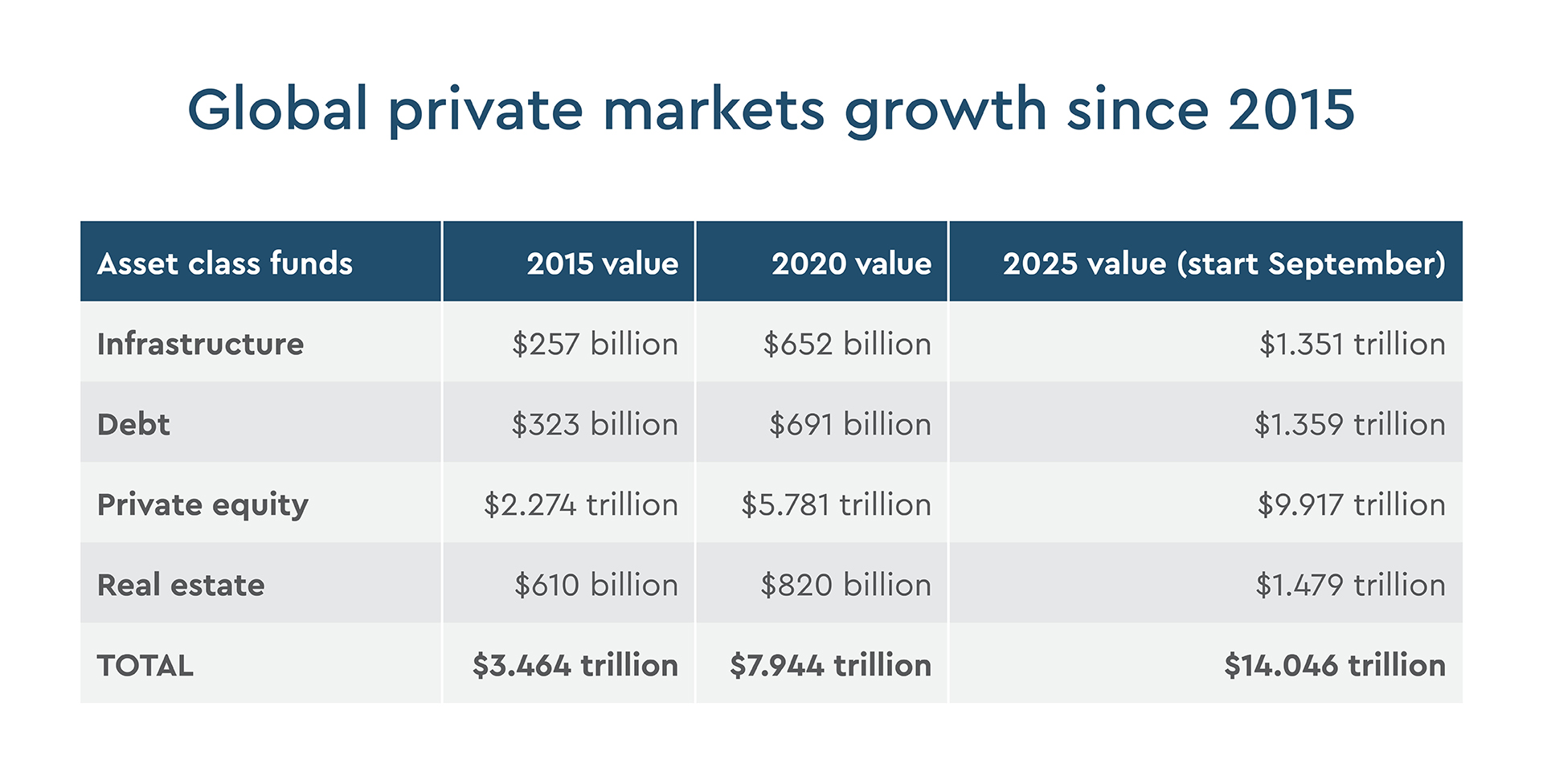

The value of global private assets funds has surged to a record $14.05 trillion this year, a rise of 77% since 2020, and 205% since 2015, and is forecast to climb 70% over the next five years to hit $23.9 trillion. Year-to-date it has risen 9.6%. This is according to the latest Global Asset Monitor from Ocorian*, a market leader in asset servicing for private markets and corporate and fiduciary administration.

Global private equity fund asset values will be the key driver of growth, doubling to $17.4 trillion by 2030, with infrastructure, private debt and real estate funds also performing strongly, taking the global value of the four sectors to $23.9 trillion.

Growth of listed and private global assets

The Global Asset Monitor, which analyses private market sectors as well as listed equities, sovereign bonds, corporate bonds and municipal agency and other bonds, estimates total global assets increased $24.08 trillion in the first eight months of this year to a record $267.0 trillion.

Within that total global private equity, private debt, infrastructure and real estate funds all hit record valuations, and Ocorian forecasts growth will continue, building on expansion over the past 10 years. However, it believes growth in assets will drive consolidation with mainstream fund managers increasingly targeting the private markets sector.

Ocorian’s analysis shows 2025’s growth in private equity global assets to $9.917 trillion has been driven in particular by Asian markets, which hit a record $2.1 trillion, up 15.8% in the first eight months of the year. They accounted for 30% of 2025’s growth despite only accounting for a fifth of assets. Assets in North America still dominate fund holdings – Ocorian’s modelling shows they reached $5.6 trillion by early September, up 9.6% year-to-date.

Yegor Lanovenko, Global Co-Head of Fund Services at Ocorian said: "The decade ahead will be transformational for global asset management. By 2030, private assets could expand by more than 70% to almost $24 trillion, with structural shifts across investor profiles and how private markets products are distributed.

“We are seeing a handful of global managers consolidate fundraising power, while new channels, including RIAs, retirement schemes, and specialist platforms, are reshaping investor engagement. For mid-market managers, this intensifying battle for distribution makes strategic partnerships, operational leverage and specialisation vital.

“At Ocorian, we help alternative asset managers handle operational and regulatory complexity across the full investment lifecycle, especially when operating scale is a differentiator and investor needs and profiles are evolving fast across asset classes."

The view of private equity fund managers

An Ocorian survey** of US-based private equity professionals who collectively manage $335.25 billion in assets reveals they expect capital from all major LP sources to rise, with family offices and pension funds leading the charge. Notably, HNW and UHNW are not expected to increase their capital subscriptions significantly (only 9.4% over the next two years) compared to 20.2% from pension funds and 17.8% from family offices.

However, as the market grows, fear of regulatory creep is nearly universal – 85% of those surveyed expect more regulation, 88% expect more industry restrictions and fines, and 80% anticipate more time spent on compliance failures.

The ambition to use more third-party providers is partly driven by this complexity. 47% are already outsourcing more over the latest lifecycle, compared to 44% who have not made changes and just 9% who have brought more in-house.

More than four out of five (81%) expect to expand their reliance on third parties in the next two years, in particular, investor services and fund administration are the functions most likely to be outsourced, though reporting is also high up the list.

How private markets break down

Global private equity fund assets grew by 10.8% this year compared with 7.7% for private debt and 10% for infrastructure. Real estate lagged with growth of 3.1% but still hit an all-time high.

Ocorian’s analysis shows more than half (51%) of private equity funds under management are domiciled in North America, while 31% are in Asia, and European funds account for 14.9% of the total.

Around 62% of private debt funds are North American-based, while 30% are in Europe and 5% in Asia.

Just under half of the underlying infrastructure assets are in North America, while 38% are in Europe. Around 38% of funds are domiciled in Europe, which is almost equal to North America. Asian-domiciled funds account for 16%.

For real estate, the asset mix is skewed to North America, which accounts for 61% of assets held, with one-fifth in Europe and one-seventh in Asia.

Vincent Calcagno, Head of U.S. Growth at Ocorian, said: “The power of the industry’s largest players is growing as the need to bulk up to compete is driving consolidation across the industry.

“Mainstream fund managers expanding into private markets and big multi-decade players have a real competitive advantage in the power of their distribution channels.

“The shape of the market in 2030 is clear – a cohort of larger asset managers will become increasingly dominant in the U.S. and globally as the line between investment options for retail and institutional investors blurs.”

*Please see notes on research Methodology

** In May 2025, Ocorian commissioned independent research company PureProfile to interview 100 senior venture capital and mid-market private equity professionals in the US and Canada working for firms with $335.25 billion assets under management

About Ocorian

Ocorian is a global leader in fund services, corporate and trust services, capital markets, and regulatory and compliance support.

Unlocking new value for its clients across jurisdictions and service lines is Ocorian’s priority; it manages over 20,000 structures on behalf of 9,000+ clients, including financial institutions, large-scale international organisations, and high-net-worth individuals.

Ocorian provides fully compliant, tailored solutions that are individual to clients’ needs, no matter where in the world they hold financial interests, or however they are structured.

The group offers a full suite of corporate, fund and private client services across a network of offices spanning all the world’s financial hubs. Locations include Bermuda, BVI, Cayman, Denmark, Finland, Germany, Guernsey, Hong Kong, Ireland, Isle of Man, Jersey, Luxembourg, Mauritius, Netherlands, Norway, Singapore, Sweden, UAE, the UK, and the U.S.

To find out more about Ocorian and its services, including regulatory information, visit www.ocorian.com

Methodology

Ocorian commissioned 5iresearch to produce the Global Asset Monitor, which considers eight main asset classes that make up the vast bulk of the world’s assets. Four of these are in public markets, namely listed equities and three categories of listed bonds (corporate, sovereign, and other, which include municipal and agency bonds). The other four are in private markets, namely private equity, private debt, infrastructure and real estate. We recognise there are other kinds of assets out there in the world, such as residential and commercial property, commodities, art and so on. But we have chosen ours to represent the easily investable universe: investors can buy public assets on exchanges, and they can participate in private markets, for example, via funds.

Private market data is sourced from Preqin unless otherwise stated, but since this data is only available infrequently and with considerable time lags, we have ‘nowcast’ it by looking at the change in value of relevant public markets since the last Preqin update was released and adjusting the values accordingly. These ‘nowcasts’ are intended only to provide a guide to recent developments.

Public market data is sourced mainly from Factset. Data was captured at market close on September 1st 2025. The equities time series looks at the largest 2,250 companies in the world today and how their market capitalisations have evolved over time. These companies represent 85% of global market capitalisation, so we have scaled up by the remaining 15% to show the full global equity market value in each year. To measure the size of the bond markets, we have considered both the market value and the face value in each country (and sector in the case of corporate bonds), each year, sourced from Factset. Where data limitations impact the sovereign results, we have derived our figures by using general government debt levels as a proxy for the bond market.

All data is converted to USD at prevailing spot rates. Currency fluctuations may therefore make an impact in the short term, but over the long term, the effect of exchange rates tends to even out almost entirely at the global level. No account has been taken of inflation.