Asset managers should work with local fund lawyers and tax advisors to choose the most suitable legal structure for their needs. In general, the limited partner (LP) framework is the most common legal form for alternative investment funds dealing in real assets.

There are good reasons for this. In a limited partnership framework, LPs’ liability is limited to the amount of their investment. They can also be extremely tax efficient, and US managers, in particular, are familiar with the structure.

But they are not the only possible structure for a European fund.

Here are three factors to consider before making a decision:

1. Regulation: lighter or heavier touch

To some extent, the choice of legal structure will depend on the investor base and its attitude to risk. Limited partnerships tend to be more lightly regulated than corporate structures. Some investors will appreciate that freedom; others may prefer the reassurance of greater regulatory scrutiny. Regulatory oversight will also impact costs and time to market.

2. Compatibility with existing funds

US managers looking to Europe will typically operate partner structures in Delaware or the Cayman Islands. Thought should be given to how a European fund will fit into the wider fund management picture, both structurally and operationally.

3. Tax and running costs

The tax transparency and neutrality of any structure will be key considerations, alongside the domicile’s network of double tax treaties.

Running costs play a key role. In general, the more heavily regulated the vehicle, the more costly it will be to maintain. But there’s a balance to be struck. It may be worth paying more in administration costs for increased freedom around marketing and investor choice.

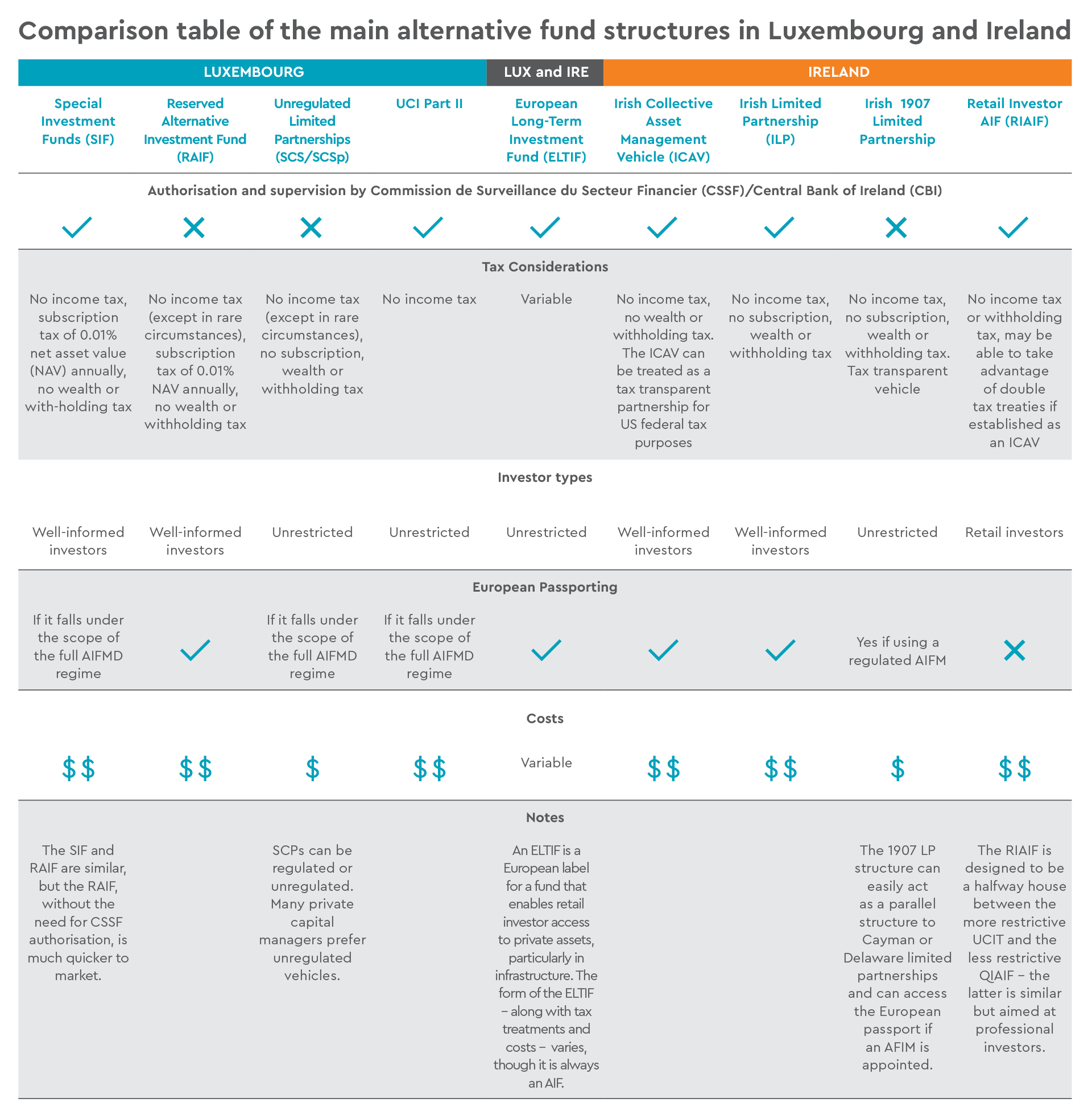

The main alternative fund structures in Luxembourg and Ireland

What about the Channel Islands?

The Channel Islands of Jersey and Guernsey are also popular destinations for overseas funds, though they are considered offshore domiciles and are incompatible with the European marketing passport. Both jurisdictions offer limited partnership vehicles and light touch regulatory regimes. They adhere to AIFMD to an extent but are not signatories to it, meaning managers avoid some of the costs associated with EU domiciles.

Jersey and Guernsey can be a gateway to European capital for managers who don’t want to use the AIFMD passport and who are not targeting the kind of institutional investors who are legally obliged to invest in EU-domiciled funds. US managers raising European capital from the Channel Islands use the NPPR regime. Both islands offer regulatory simplicity and easy access to both the UK and European mainland.

Ocorian Fund Services

At Ocorian we have extensive experience supporting US fund managers with setting up alternative investment funds in Europe and administering them throughout their lifecycle.

We have teams across seven jurisdictions in Europe that provide a high touch, technology first approach combined with local expertise.

We offer a full service offering from fund set up and administration through to fund accounting, AIFM, investor services and depositary.

- Fast and efficient set up of funds in Europe

- Teams based in the UK, Jersey, Guernsey, Ireland, The Netherlands and Luxembourg

- AIFM in Ireland and Luxembourg

- Expertise in administering vehicles parallel to existing US or Cayman structures

- Jurisdiction agnostic

- Full service provider

Our business development team in the US will be happy to discuss your European requirements and guide you through the process. Contact us for more information.

Download ‘A guide to setting up your fund in Europe’

Fill in the form to download your free guide of ‘How to set up a fund in Europe’.