What is happening to alternative fund managers’ investment risk appetite over the next 12 months?

Alternative fund managers’ risk appetite is set to expand over the next 12 months as companies focus on acquisition opportunities amid expectations that inflation and interest rates will fall, new research* from Ocorian, the specialist global provider of services to financial institutions, real asset managers, corporates and high net worth individuals shows.

Nearly six out of 10 (57%) senior executives questioned in the international study say their organisation’s investment risk appetite will increase in the year ahead – more than double the 25% who say their organisation’s investment risk appetite will fall.

What’s driving investment risk appetite in 2024?

Ocorian’s study among fund managers at private equity, venture capital and real estate companies shows investment risk appetite next year is expected to be much higher than this year.

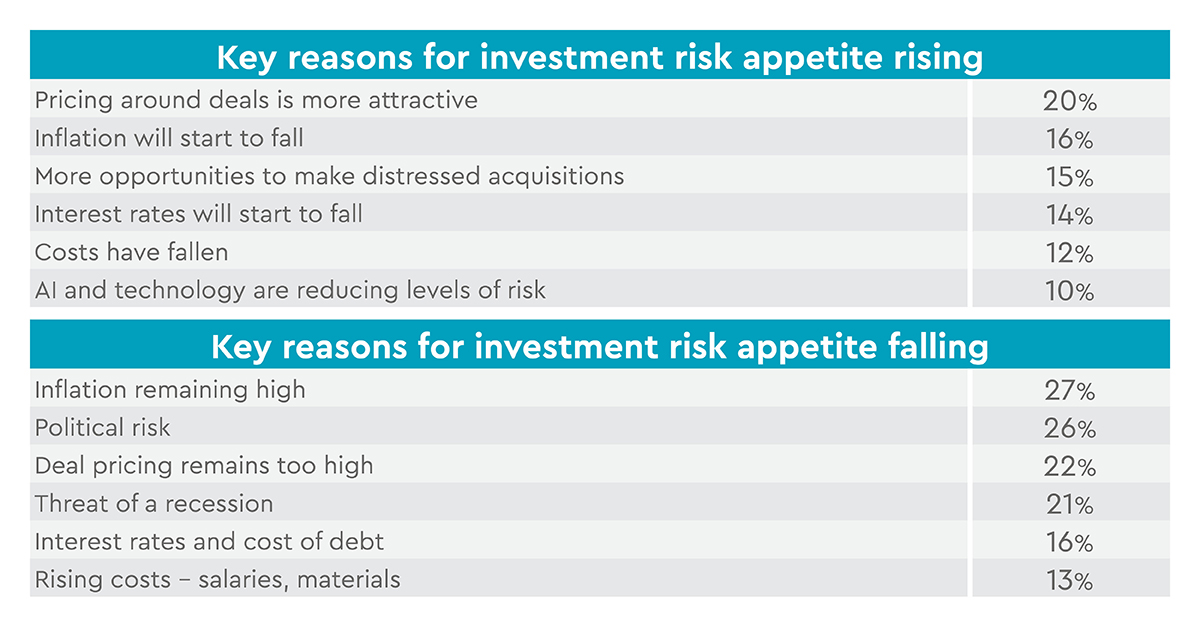

The key reason for the rise in investment risk appetite in the year ahead is the belief that pricing around deals will become more attractive. One in five (20%) selected that as one of their top three reasons for an increased investment risk appetite while 16% selected lower inflation and 15% said more opportunities to make distressed acquisitions among their top three.

Major concerns identified in the study are worries that inflation may not fall, global political uncertainty and the view that acquisition prices are still too high. Around 26% of firms whose investment risk appetite is falling cited political uncertainty while 27% highlighted inflation and 22% deal pricing as the reason for their declining risk appetite.

Ocorian’s study found companies worldwide maintained their focus on risk mitigation over the last 12 months with 56% having already expanded their risk management teams and 53% have invested in new technology. Around 45% expanded EIS schemes last year to ensure key staff did not leave.

The focus on risk mitigation continues

Companies are still very much focused on risk mitigation. Almost half (53%) will enhance employee incentive schemes (EIS) to help retain key staff while 52% plan to expand their risk management team and 50% will invest more in new technology in order to mitigate risks.

Paul Spendiff, Head of Business Development – Fund Services, at Ocorian, said: “Investment risk appetite is clearly increasing with senior executives and major investors expecting a shift in global macroeconomic conditions as well as more opportunities for acquisitions at more attractive prices.

“The optimism about the year ahead and growing confidence is tempered by a focus on risk management and there is evidence from the study that companies have invested this year in new technology and risk management staff in order to expand in the year ahead.

“That focus is being maintained and we are seeing growing demand for our services as we help our clients solve these complex issues. In addition there are major concerns about the year ahead ranging from global political uncertainty and heightened global tensions in the Middle East and Ukraine as well as the risk of recession in major economies.”

The table below shows the key reasons for investment risk appetite rising or falling identified by the research.

Ocorian is a global leader in real asset fund administration, capital markets, corporate and fiduciary services. Ocorian help its clients solve complex problems so they can optimise investment performance and build their competitive advantage.

*Ocorian commissioned independent research company PureProfile to conduct a global study of 301 senior executives which included 150 alternative fund managers. The survey was carried out among board directors at companies with annual turnover of more than $250 million, fund managers working in family offices, private equity, venture capital and real estate; and senior executives working in capital markets focused on structured credit, CLOs, securitisation, mortgage-backed securities and asset-backed securities. Respondents to the survey, which was conducted in November 2023, were based in the UK, continental Europe, Asia, the Middle East and North America