Ocorian's Outlook 2024 report* shows alternative fund managers are increasingly reliant on outsourcing key services and the trend is set to accelerate over the next three years, according to Ocorian, a global market leader in alternative investment fund administration.

Fund managers will increase level of outsourced services over the next three years

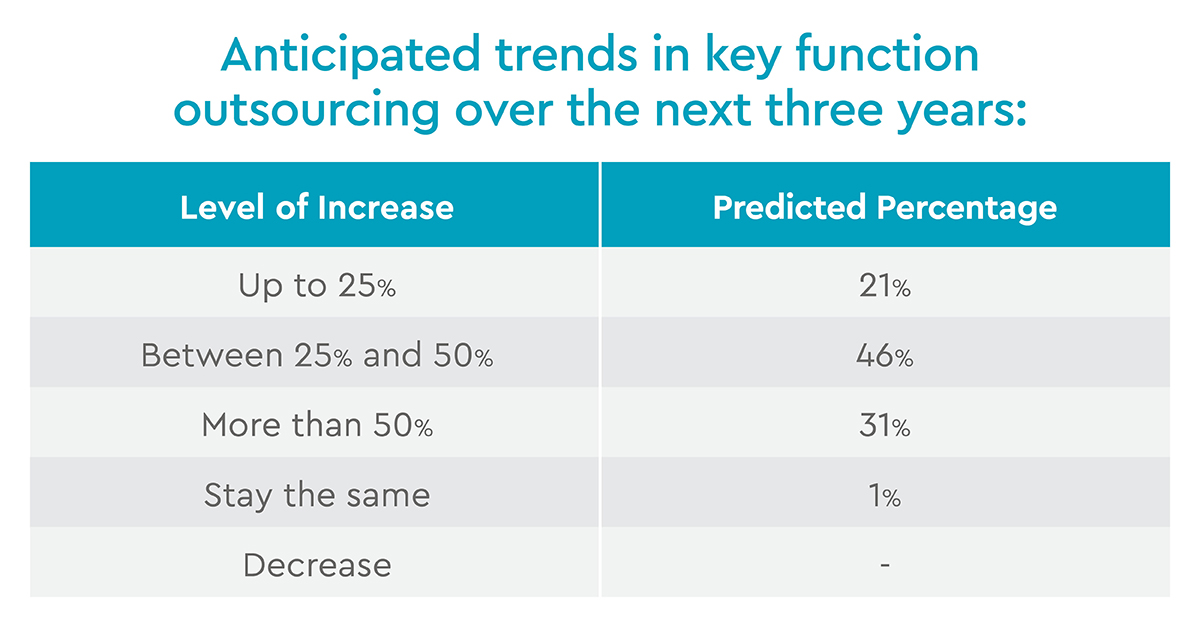

Almost all (99%) private equity, venture capital and real estate fund managers questioned in Ocorian’s study, regardless of location, plan to increase the level of outsourcing at their organisation over the next three years with nearly half (46%) planning to increase the level of outsourcing by between 25% and 50%.

Budget for regulation and compliance key area for investment

That builds on strong expansion in the past two years with 98% of fund managers reporting a rise in the level of outsourcing. One key area for investment was regulation and compliance with 91% of fund managers saying budgets for those outsourced services had increased in the past two years.

However the study found some dissatisfaction with the services provided by outsourcers with 10% saying the level of service is average or poor and the same number saying outsourcers are average or poor at solving complex business problems for them.

Key criticisms include poor responsiveness, a limited scope of service, technology issues and poor onboarding. Some fund managers complained about the level of expertise of outsourcers.

Nearly half will consolidate services with one partner

Criticisms of the services provided help explain a shift away from relying on a range of providers; nearly half (49%) questioned say they expect their organisation to consolidate to one partner or a smaller number of partners. By contrast 39% plan to use a wider range of partners and around 11% plan to switch from their current provider.

Nearly half (45%) questioned say it is very important their provider offers a wide range of services while 50% say it is quite important.

Paul Spendiff, Head of Business Development – Fund Services, at Ocorian said: “Outsourcing of services is clearly already very important to alternative fund managers and set to grow in importance over the next three years with almost all firms planning to increase their level of outsourcing.

“Increasing confidence about fund launches and capital raising is very much reliant on the expert support of outsourcing partners but there are issues companies need to address if they are to become successful partners for fund managers.

"There are significant numbers of fund managers who are unimpressed with the service they receive and quite often on basic issues such as expertise. Where outsourcers fail to improve and expand their product offering managers are increasingly switching to firms offering high touch service and a single source consolidated solution.”

The table below shows the predicted increase in the level of outsourcing over the next three years among alternative fund managers.

About Ocorian Fund Services

Ocorian’s fund services team delivers operational excellence across fund administration, AIFM, depositary and accounting services to the world’s largest financial institutions along with dynamic start-up fund managers and boutique houses. It’s team of over 300 funds specialists work across all major asset classes of alternative investment funds such as private equity, real estate, infrastructure, debt and venture capital, whilst its specialist Islamic Finance team is a leading provider of Sharia-compliant investment structures.

*Ocorian commissioned independent research company PureProfile to conduct a global study of 301 senior executives. The survey was carried out among board directors at companies with annual turnover of more than $250 million, fund managers working in family offices, private equity, venture capital and real estate; and senior executives working in capital markets focused on structured credit, CLOs, securitisation, mortgage-backed securities and asset- backed securities. Respondents to the survey, which was conducted in November 2023, were based in the UK, continental Europe, Asia, the Middle East and North America and included 150 alternative fund managers