78% of private credit executives expect the trend to increase over the next three years in Europe, study shows

But there are concerns that enough private debt capital is available to meet demand

The switch by private credit fund managers to finance infrastructure initiatives is set to gather pace in Europe over the next three years, new Nordic Trustee research with executives in the sector shows.

Nearly four out five (78%) questioned expect the trend towards funding European infrastructure projects to increase, with 21% predicting a substantial increase, the study by Nordic Trustee, part of global capital markets services provider Ocorian, found.

The study with executives across the UK and Ireland, Germany, Switzerland, Benelux, the Nordics and Eastern Europe found some concerns about whether there is sufficient private debt capital available for infrastructure lending in the next three to five years.

Nearly a quarter (23%) questioned believe additional lending capacity is needed to meet expected demand for debt financing in European infrastructure investments, while another 5% are unsure. The rest (72%) believe there is enough private debt capital available.

The research, with professionals working across private credit and debt fund management, private equity and corporates using private credit as a source of funding and for debt advisory firms, found construction financing is currently the most in demand in the infrastructure sector.

Around 87% chose construction financing as one of their three loan types facing the highest demand ahead of 76% choosing senior loans as one of their top three. Around 56% selected junior loans and more than half (51%) picked mezzanine financing as one of their top three. About 10% said all loan types were experiencing high demand.

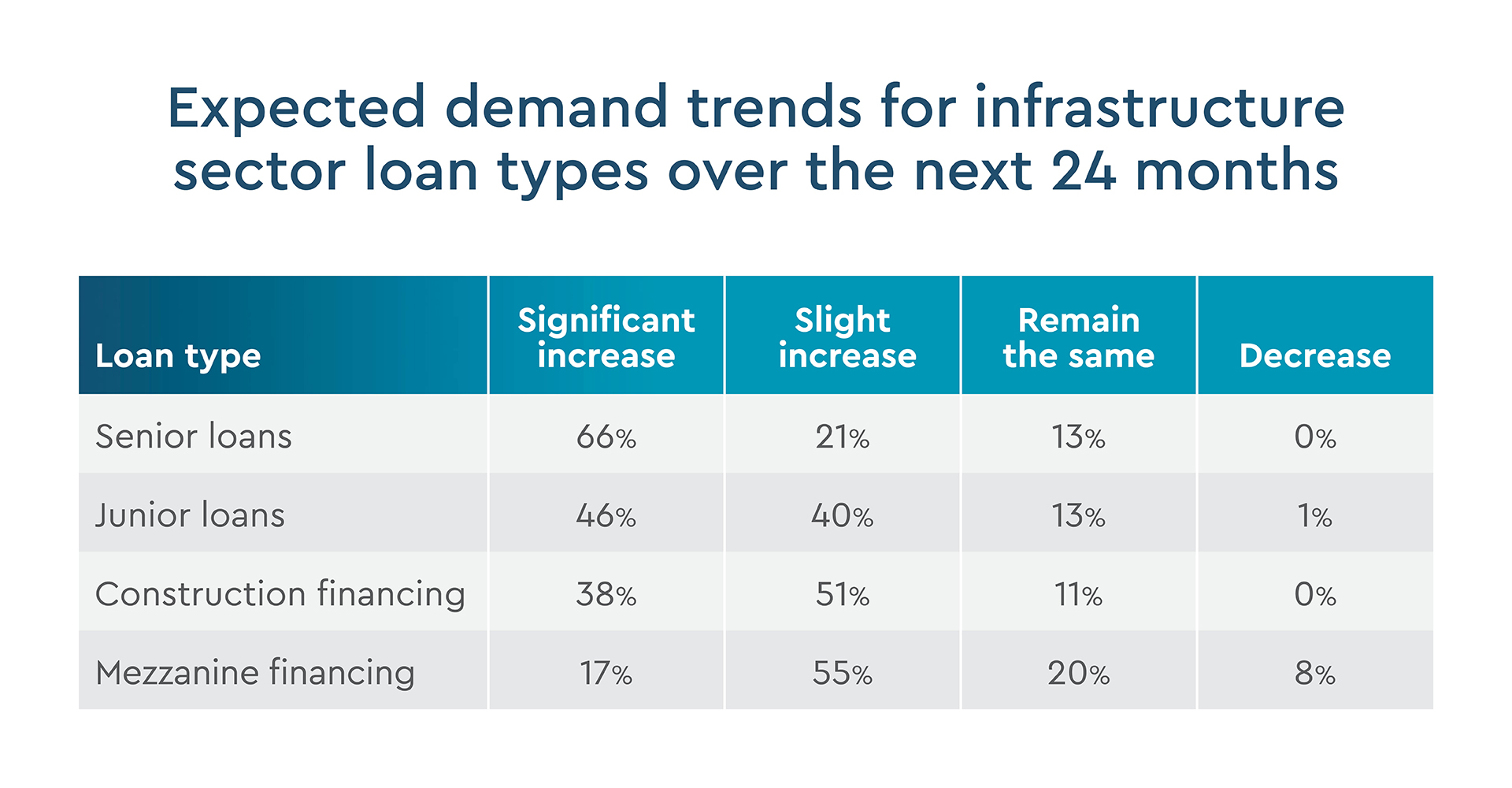

In the next two years they expect senior loans to see the highest increase in demand, with 66% predicting significant increases ahead of 46% predicting significant increases in demand for junior loans. However, the table below shows all types are expected to see strong growth in demand.

Stefan Luthringshauser, CEO Germany at Nordic Trustee, said: “Private credit fund managers are increasingly looking at financing infrastructure initiatives, and that trend is expected to accelerate over the next three years, with all types of loans seeing strong growth.

“The outlook for the sector is strong with the only concern being a lack of private debt capital to meet expected demand over the next three to five years.”

With over 30 years’ expertise in the bond and loan markets and a track record of facilitating 14,000 transactions over the years, Nordic Trustee brings an unparalleled depth of knowledge to support bond and loan transactions in the UK and Europe.

It differentiates itself through its proprietary technology, extensive restructuring expertise which includes more than 450 restructurings and 2,000 noteholder meetings, and a problem-solving approach that streamlines complex transactions for issuers and investors alike. Nordic Trustee is committed to delivering best-in-class trustee and loan agency services tailored to the needs of issuers, investors, and intermediaries.

*In March 2025 Ocorian commissioned independent research company PureProfile to interview 210 private credit professionals working across private credit and debt fund management investing in private debt, private equity using private credit, borrowers using private credit as a source of funding, and debt advisory. Respondents were based in the UK and Ireland, Germany, Switzerland, Benelux, the Nordics and Eastern Europe