Eileen McCarroll, Global Head of Depositary Services at Ocorian, discusses the roles and responsibilities of the depositary under the Alternative Investment Fund Managers Directive (AIFMD).

What is a depositary?

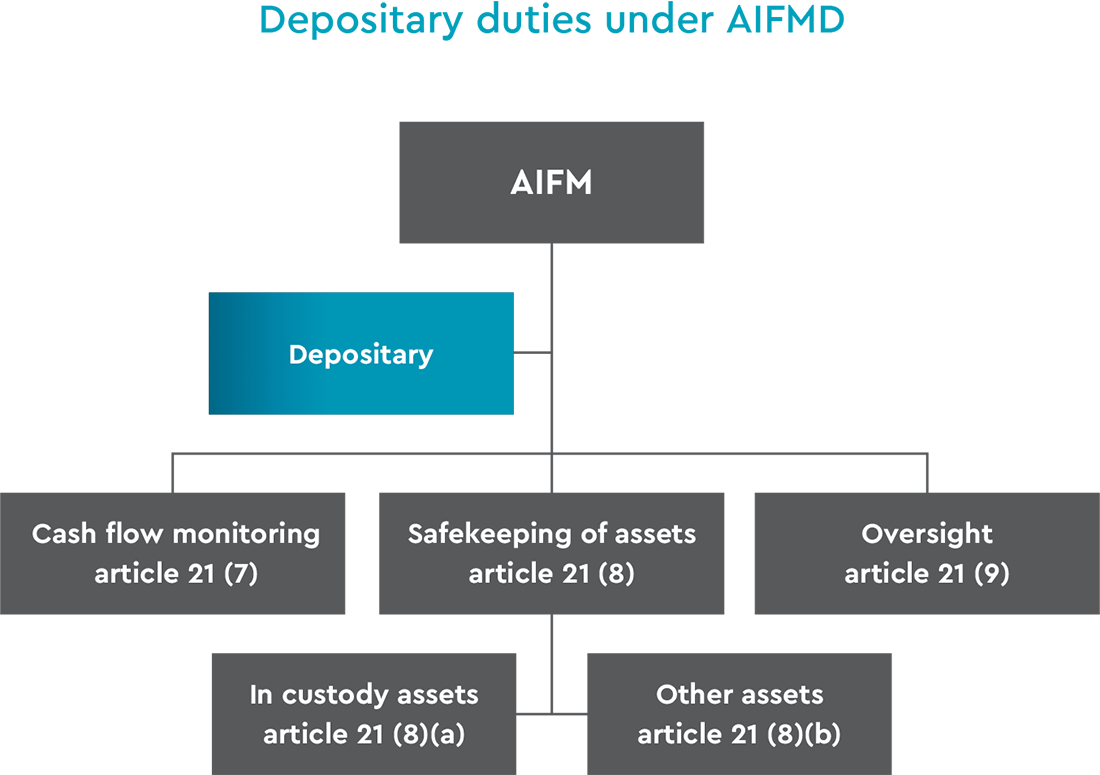

Under the Alternative Investment Fund Managers Directive (AIFMD), a depositary is an independent third party responsible for the safekeeping of assets, cash flow monitoring, and oversight duties of an Alternative Investment Fund (AIF). The depositary can be a bank or a professional depositary.

Key responsibilities of a depositary include:

- Cash monitoring: The depository tracks the cash flow of the alternative investment fund (AIF) to ensure proper handling of funds.

- Asset verification: The depository verifies that the AIF's assets are properly held and accounted for.

- Oversight: The depository oversees the activities of the AIFM to make sure they comply with AIFMD regulations.

The depositary must be independent of the AIF and its manager to avoid conflicts of interest.

Who requires a depositary?

An AIFM must appoint a single independent depositary (which may not be the AIFM itself) in respect of each AIF it manages. A depository is essentially the watchdog of the fund. It's safeguards assets, and it looks after the best interests of investors.

A depositary of an EU AIF must be located in the AIF’s home member state and must be any of (a) a credit institution; (b) a MiFID investment firm authorised to provide custodial services and which meets certain capital requirements; (c) an entity which, on 21 July 2011, was eligible to act as a depositary under the UCITS Directive (and which is subject to prudential regulation and ongoing supervision).

For non-EU AIFs, the depositary must be established in (a) the same third country as the AIF; or (b) the home member state of the AIFM managing the AIF; (c) the member state of reference of the AIFM managing the AIF.

An Alternative Investment Fund Manager (AIFM) requires a depository under certain conditions:

- A depository becomes mandatory if the AIFM's Assets Under Management (AUM) surpasses €500 million (around $540 million USD).

- In some cases, even with AUM below €500 million, a depository might be required if the AIFM uses a high level of leverage (borrowing to invest).

- If the AIFM is considered "sub-threshold," meaning it manages assets below a certain limit, then a depository is not mandatory.

What oversight functions does the depositary perform?

The oversight role of a depository for an AIF is a continuous process that begins even before investments start flowing into the fund. Here's a breakdown of how it works:

Initial assessment: The relationship starts with a deep dive into the AIFM's (manager's) operations. The depository meticulously examines the AIFM's controls and procedures to ensure they comply with AIFMD regulations. This initial due diligence lays the groundwork for ongoing monitoring.

Close collaboration: The depository doesn't just assess – it builds a collaborative relationship with the AIFM. Throughout the fund's lifecycle, they work closely together. This ongoing communication allows the depository to maintain a thorough understanding of the fund's activities.

Monitoring throughout the lifecycle: The depository's watchful eye extends beyond the AIFM. They also oversee other key service providers involved with the fund, like fund accounting and investor services. By monitoring these entities, the depository ensures everyone fulfils their designated tasks correctly.

Specific areas of focus: The depository's oversight includes specific aspects crucial to the fund's health. For instance, they verify that the Net Asset Value (NAV) is calculated accurately according to AIFMD requirements and relevant local regulations. Additionally, they ensure the investor register is meticulously maintained following the AIFM's established processes and controls.

In essence, the depository acts as a vigilant guardian, continuously monitoring the AIFM and other service providers to safeguard the AIF and its investors. They establish a strong foundation through due diligence and then leverage close collaboration and focus on critical areas to ensure the fund operates in accordance with regulations and protects investor interests.

Oversight duties include:

- Obligations to safeguard or otherwise verify ownership of AIF assets.

- Monitoring of cash flows in respect of the AIF.

- Ensure that transactions relating to units in the AIF are carried out in.

- accordance with fund documentation.

- Ensure that appropriate valuations are applied.

- Ensure that management instructions are carried out.

- Ensure that consideration for AIF assets is received in normal timeframes; and

- Ensure that its income is applied appropriately.

Is the depository the same as the AIFM or are they separate?

The depositary and the AIFM (Alternative Investment Fund Manager) are separate entities. The depository acts as a supervisor for the AIFM, with the following key responsibilities:

- Oversight: The depository monitors the AIFM to ensure they perform their duties correctly according to AIFMD regulations. This involves due diligence on the AIFM and ongoing interaction.

- Issue escalation and reporting: If the AIFM makes a mistake, the depository is responsible for addressing it, resolving the issue, and reporting it to investors.

How does the depositary add value?

Fund structures are complex and fund admin teams can make mistakes, so the additional layer of oversight that the depositary provide ensures that transactions are properly documented and recorded, reducing the risk of potentially expensive and damaging non-compliance with AIFMD. It also allows the AIFM to focus on core activities and wider value-added projects:

- Additional oversight: The depositary acts as an extra layer of scrutiny on top of the AIFM's internal controls. They review and ensure transactions are properly documented and recorded, reducing the risk of errors or fraud that could harm investors.

- Due diligence and review: The depositary performs due diligence on the AIFM's administrator at the outset and conducts ongoing reviews throughout the year. This ensures the administrator has proper procedures in place to safeguard investor assets.

- Compliance and reporting: Depositaries play a role in ensuring compliance with regulations. Their reviews and reports complement those done by the AIFM's compliance team and auditors, providing additional comfort to investors.

- Knowledge and expertise: The depositary's knowledge and expertise can be invaluable in helping those unfamiliar with European regulation. We work very closely with overseas managers working in Europe to explain the regulation framework and ensure they follow the right procedures. For example, we will support a US manager dealing with an Irish fund and marketing into Germany for the first time by helping them to navigate the AIFMD framework and operate compliantly, ultimately protecting investors.

In essence, the depositary acts as an independent safeguard that verifies proper procedures are followed, protects against errors, and ensures investor assets are handled according to regulations.

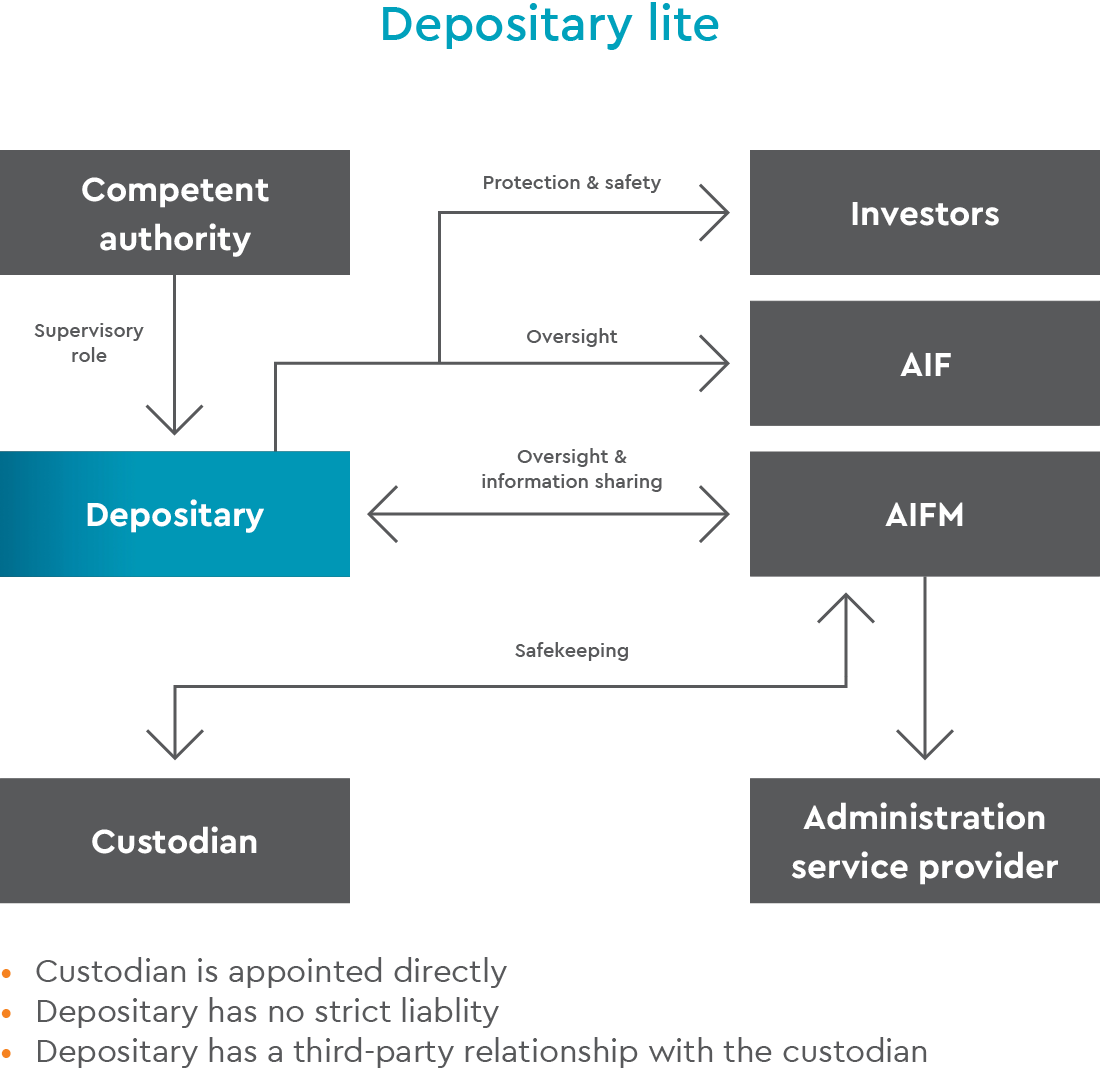

What is depositary lite?

In essence, Depositary Lite offers a similar service to a standard depositary but with less responsibility for the depositary itself. The AIFM takes on more responsibility by directly appointing the custodian for certain assets.

This option comes into play when a non-EU AIFM markets its non-EU fund to certain EU countries like Germany or Denmark. These countries require a depositary but allow a "lighter" version with reduced liability.

In short:

- A custodian is appointed directly by the AIFM for the safekeeping of assets.

- The depositary has no strict liability for the assets.

- The depositary has a third-party relationship with the custodian.

- The depositary provides most of the same services as a standard depositary, including cash flow monitoring and asset verification.

What is the difference between depositary and depositary lite?

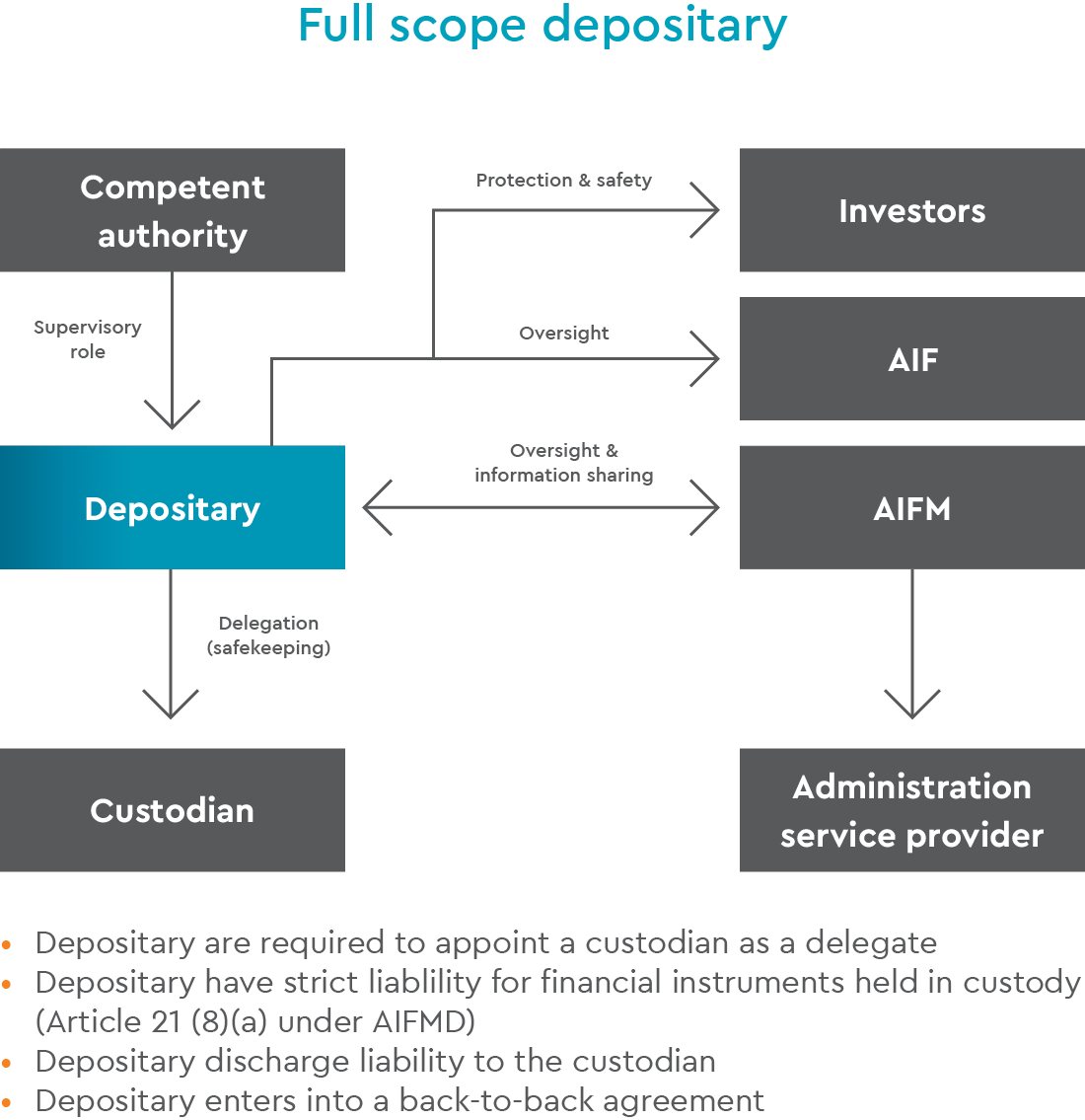

Depositary Lite is a version of the standard depositary service with a key difference: reduced liability for the depositary. Here's the difference between the two:

Standard depositary:

- Appointed by the AIFM (Alternative Investment Fund Manager).

- Oversees the AIFM, the custodian (if applicable), and protects investors.

- Holds strict liability for certain assets (like financial instruments) under their custody. This means if something happens to those assets, the depositary is financially responsible.

Depositary lite:

- Also appointed by the AIFM.

- Provides most of the same services as a standard depositary, including cash flow monitoring and asset verification.

- However, the depositary has no liability for the assets.

- In contrast to a standard depositary, the AIFM directly appoints the custodian for assets requiring custody (typically financial instruments).

Can the depositary function be performed in-house?

The role can be performed in-house or by an independent third party.

The core role of a depositary is to act as an independent overseer, ensuring the AIFM (manager) and administrator perform their duties correctly and ensure the proper governance frameworks are in order. This independence is compromised if the depositary function were performed internally.

In the alternative funds industry, a separate and independent depositary is the norm due to the importance of impartiality.

Having the depositary function in-house alongside the administrator could create conflicts of interest. It would be difficult to ensure the depositary is objectively monitoring the administrator's activities.

While having an internal depositary might streamline information flow, the potential loss of independence outweighs this benefit.

Any depository should have experienced, knowledgeable teams who have a deep knowledge of the asset class, the role and actions of the depository should not infringe on the day-to-day business of the AIF or AIFM. And if anything should be flexible to fit around the manager's day-to-day, adapting its processes to meet the individual processes of the client.

What should you look for when appointing an independent, third-party depositary?

I would stress the experience, respectful independence, and adaptability when choosing a third-party depositary.

Experience and knowledge:

The depositary team should have extensive experience and in-depth knowledge of the specific asset class the AIF (Alternative Investment Fund) invests in, so they understand the relevant risks and regulations.

Respectful independence:

The depositary's actions and procedures shouldn't interfere with the AIFM's day-to-day operations. They should maintain a balance between thorough oversight and respecting the AIFM's autonomy.

Flexibility and adaptability:

The ideal depositary should be flexible and willing to adapt their processes to accommodate the AIFM's specific needs and internal procedures.

No conflicts of interest:

As the depositary works closely with the administrator, there should be no conflicts of interest, and if there are, these should be closely monitored and disclosed to the AIF’S investors.

The AIFM might choose an external depositary even if their administrator is internal. This could be because the AIFM prefers the external depositary's services or expertise.

Smaller AIFMs might also opt for an external depositary if they lack the resources to handle depository functions internally.

Ocorian Depositary Services

At Ocorian, our depositary teams based in Belfast, Luxembourg and Dublin we ensure the effective protection, monitoring and oversight of your fund’s assets.

We have a deep understanding of the needs of alternative investment fund managers and have a strong track record in supporting funds to fulfil private equity, venture capital, infrastructure, real estate, debt, and funds of funds strategies.

Contact us for further information about our depositary and fund administration services.